2022 Q2 Construction Industry Economic Outlook & Trends

Welcome to the second edition of the Swinerton Quarterly Market Analysis. Always striving to continuously improve in all we do, we have added a Material Lead times section and Swinerton Craft hours. We will continue to update and share information as it relates to:

- Construction spending, employment, confidence

- Architectural Billing Index

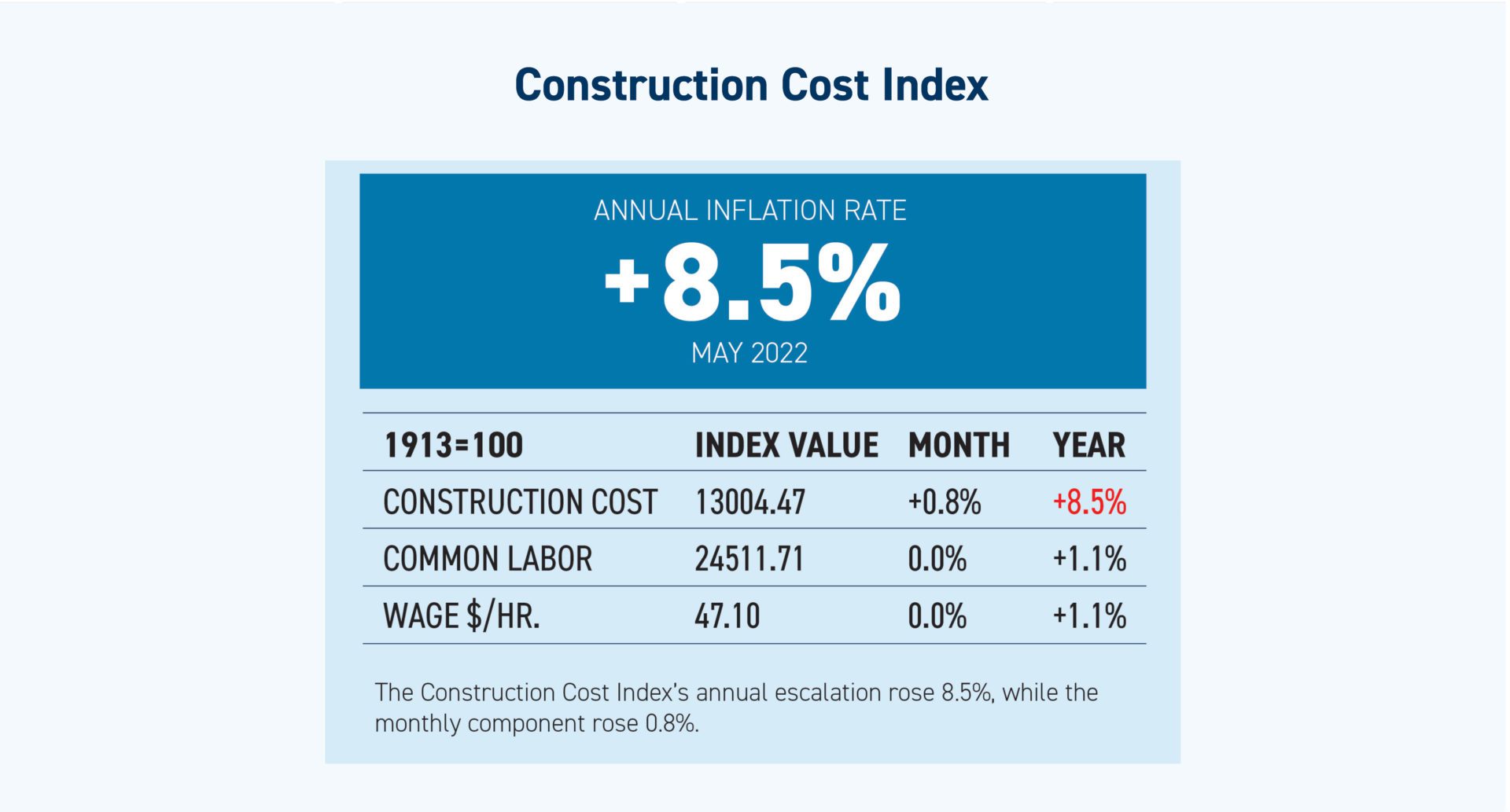

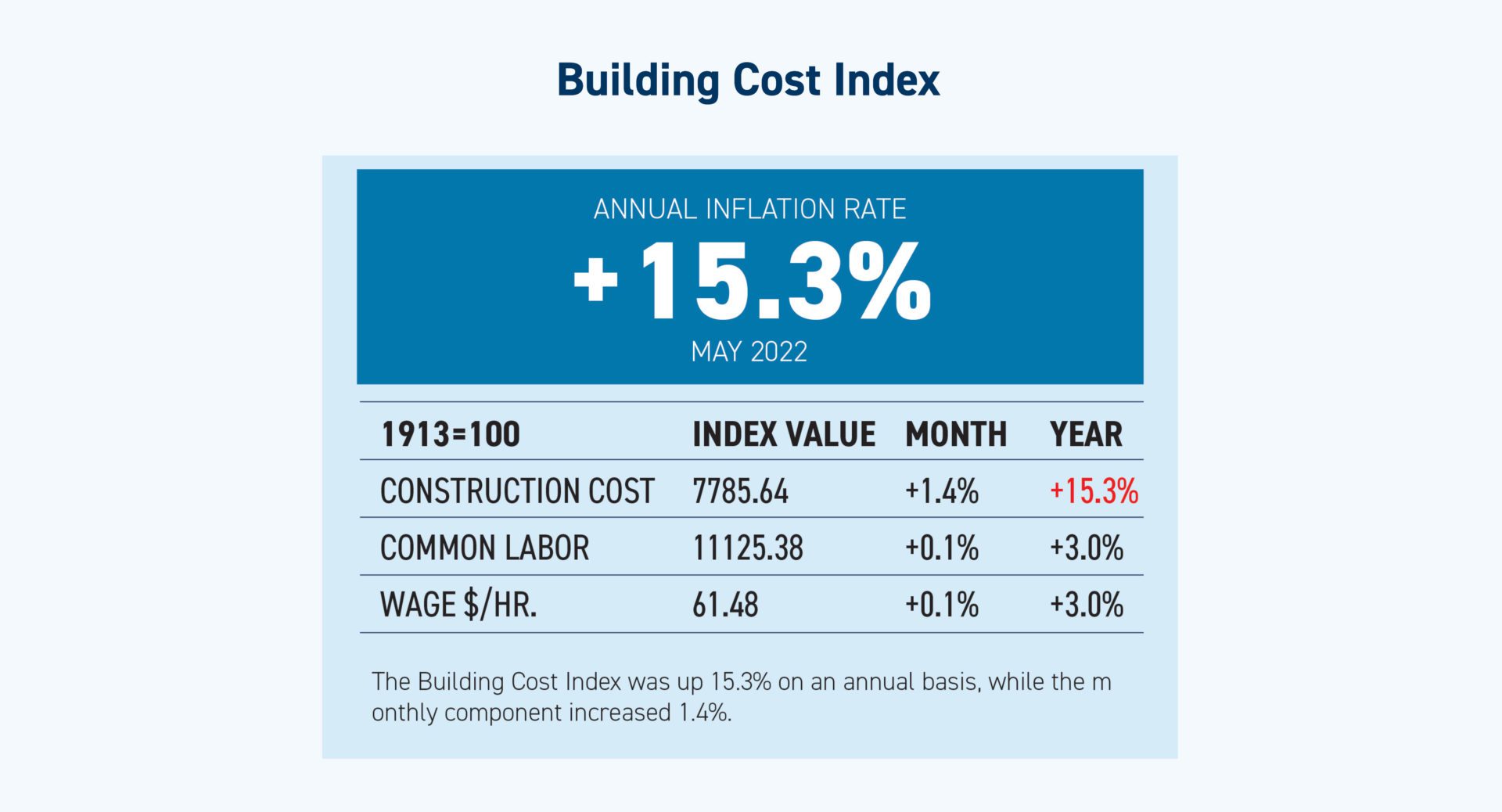

- ENR CCI and BCI cost indexes’

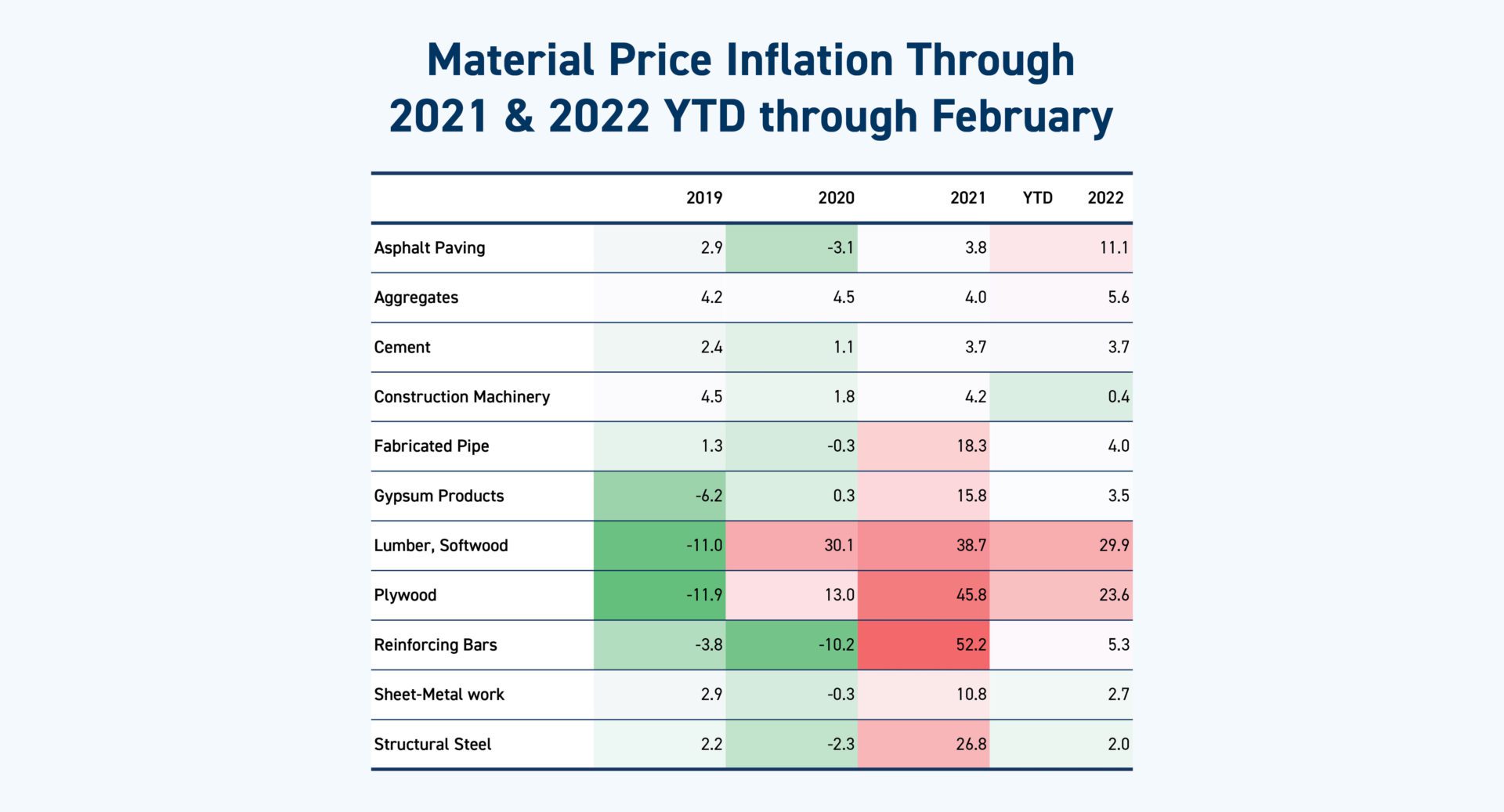

- Specific material price movements

As the first quarter came to a close, our return to normalcy was spoiled by two things, the war in Ukraine and continued inflation. The Russian invasion of Ukraine reversed all downward trends we were starting to see. Material costs that were falling in late 2021 and early 2022 have regained their upward momentum; the material prices in 2022 will surpass the peak we saw in 2021. Prediction by leading authorities has material costs easing in 2023 and beyond.

Early contractor involvement will be critical to mitigating cost issues, controlling project budgets, and creating material procurement strategies that minimize project schedule impacts.

Q1 2022 Market Analysis

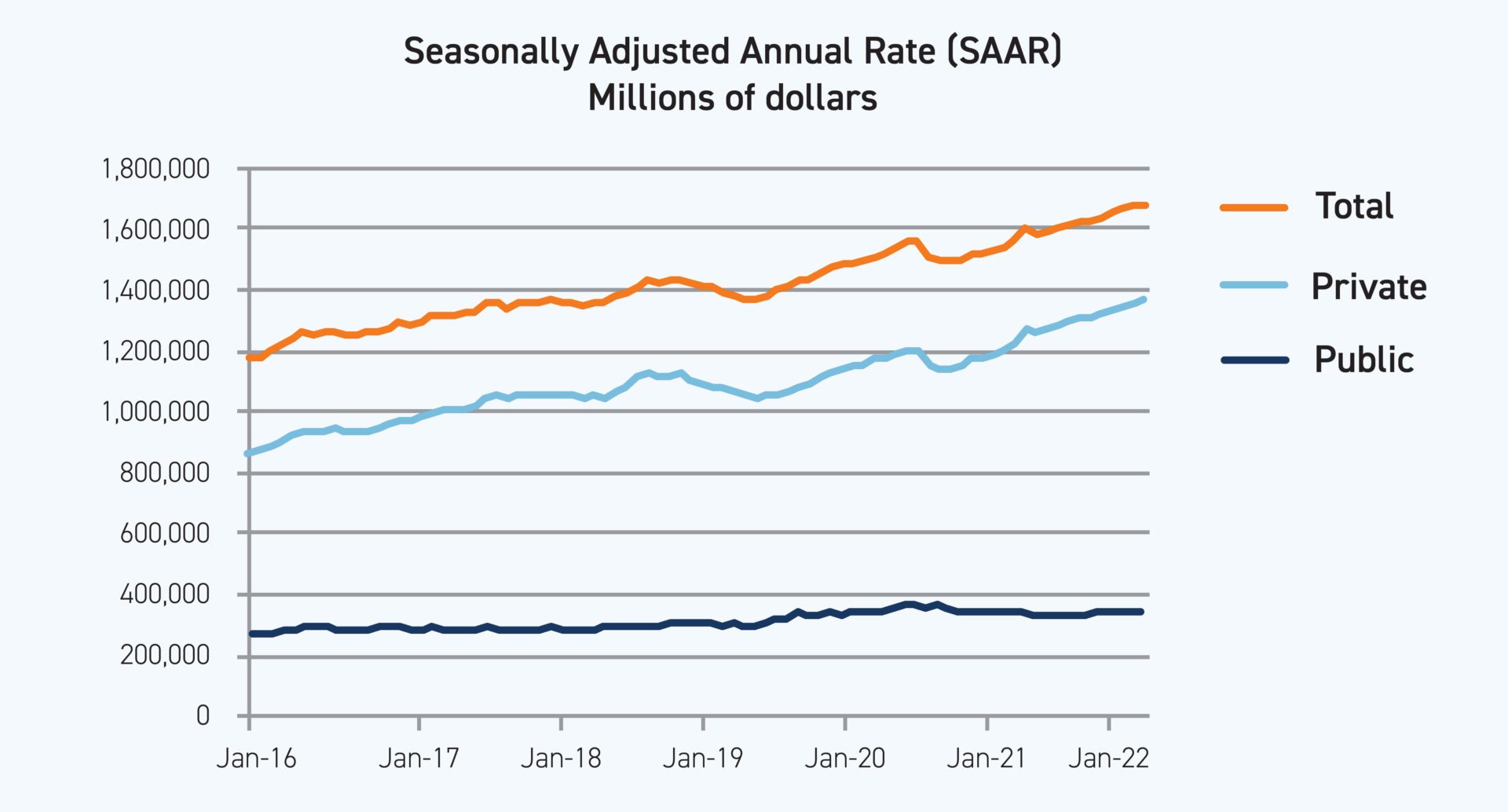

Total Construction Spending

Source: U.S. Census Bureau, May 1, 2022

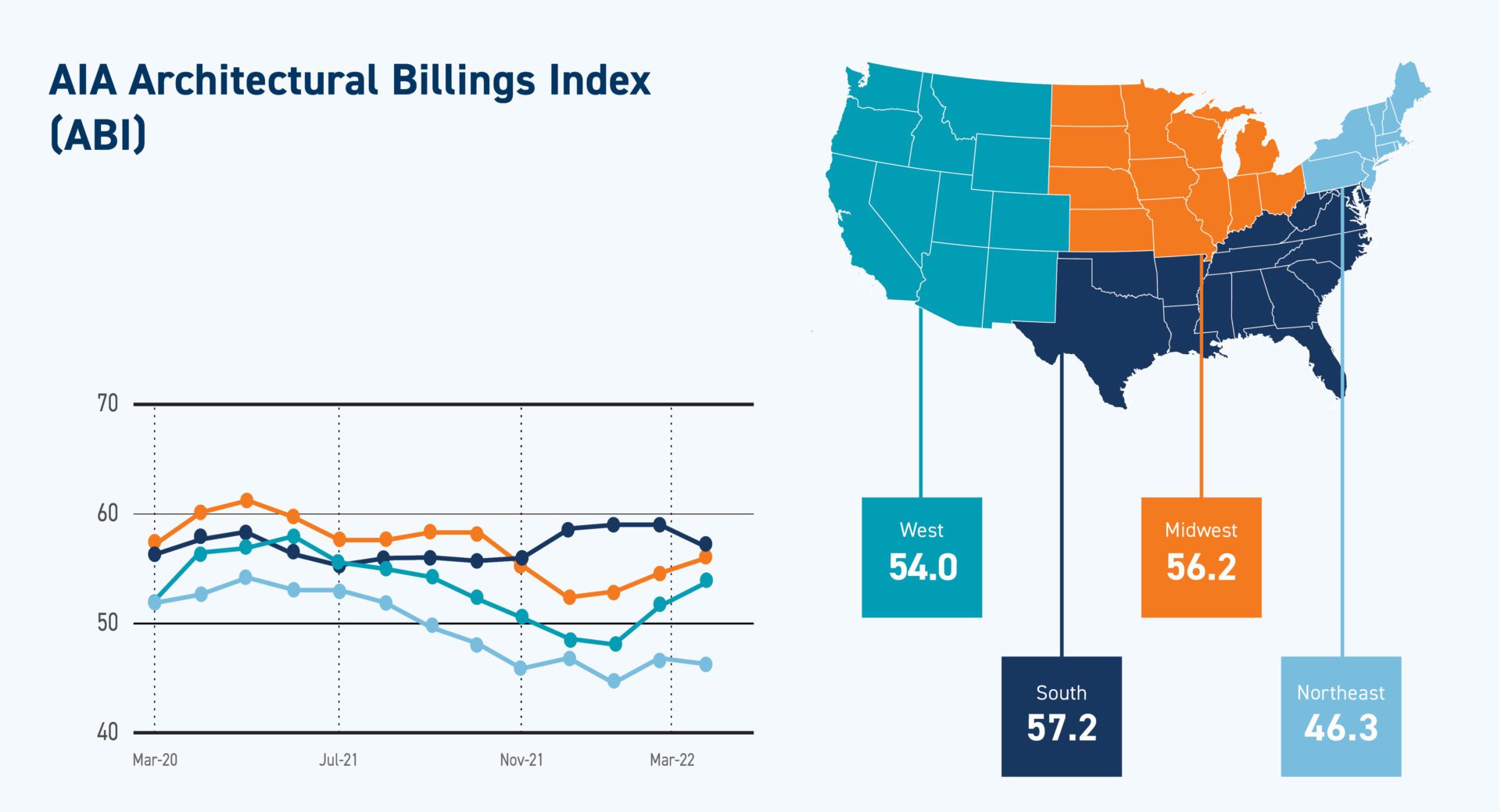

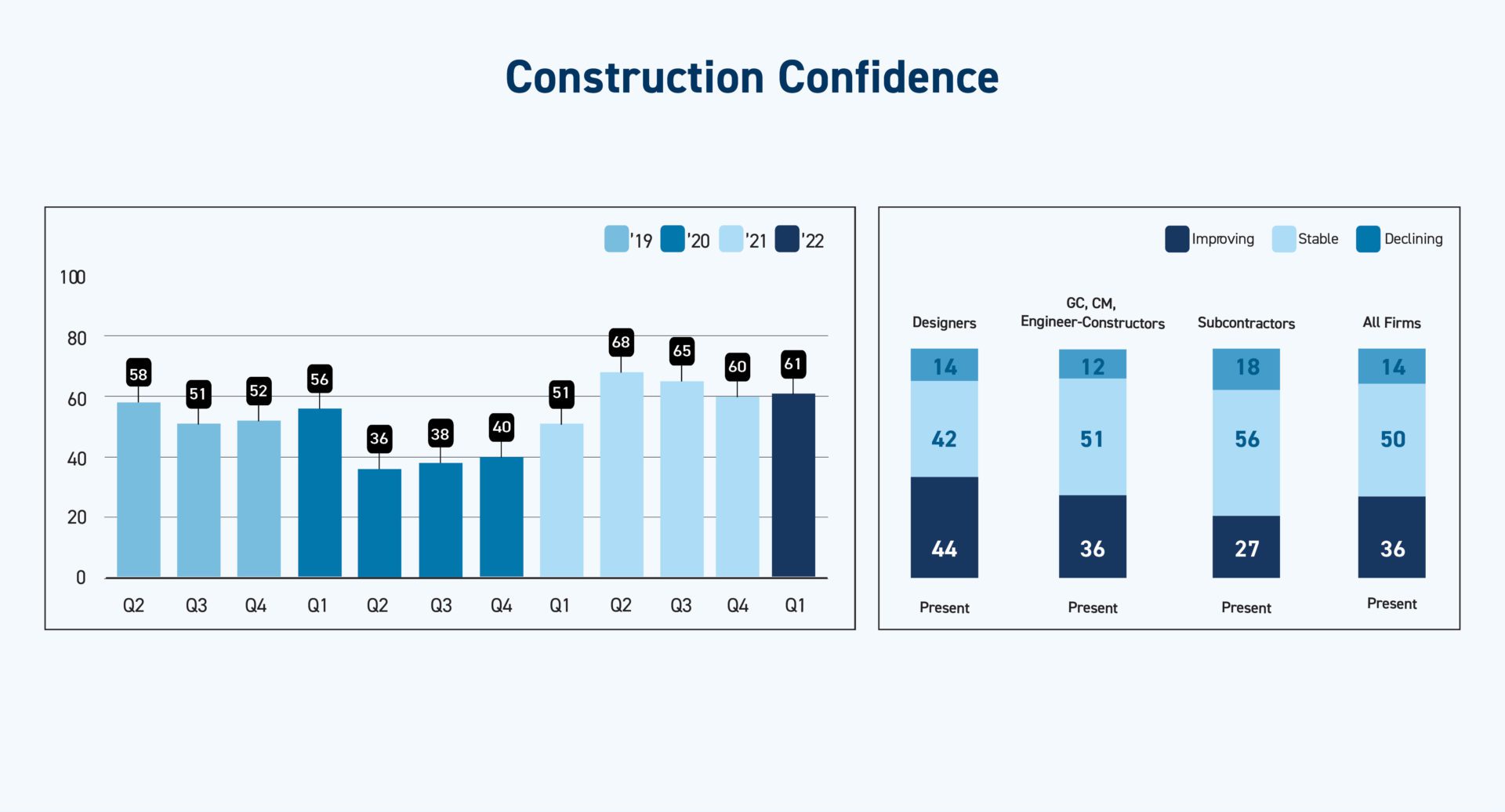

The Architecture Billings Index (ABI) is a leading economic indicator that leads nonresidential construction activity by approximately 9-12 months. A score of 50 equals no change from the previous month. Above 50 shows increase; below 50 shows decrease. 3-month moving average.

Business conditions strengthen at firms located in the South, but remain soft at firms in the Northeast and West.

Source: AIA

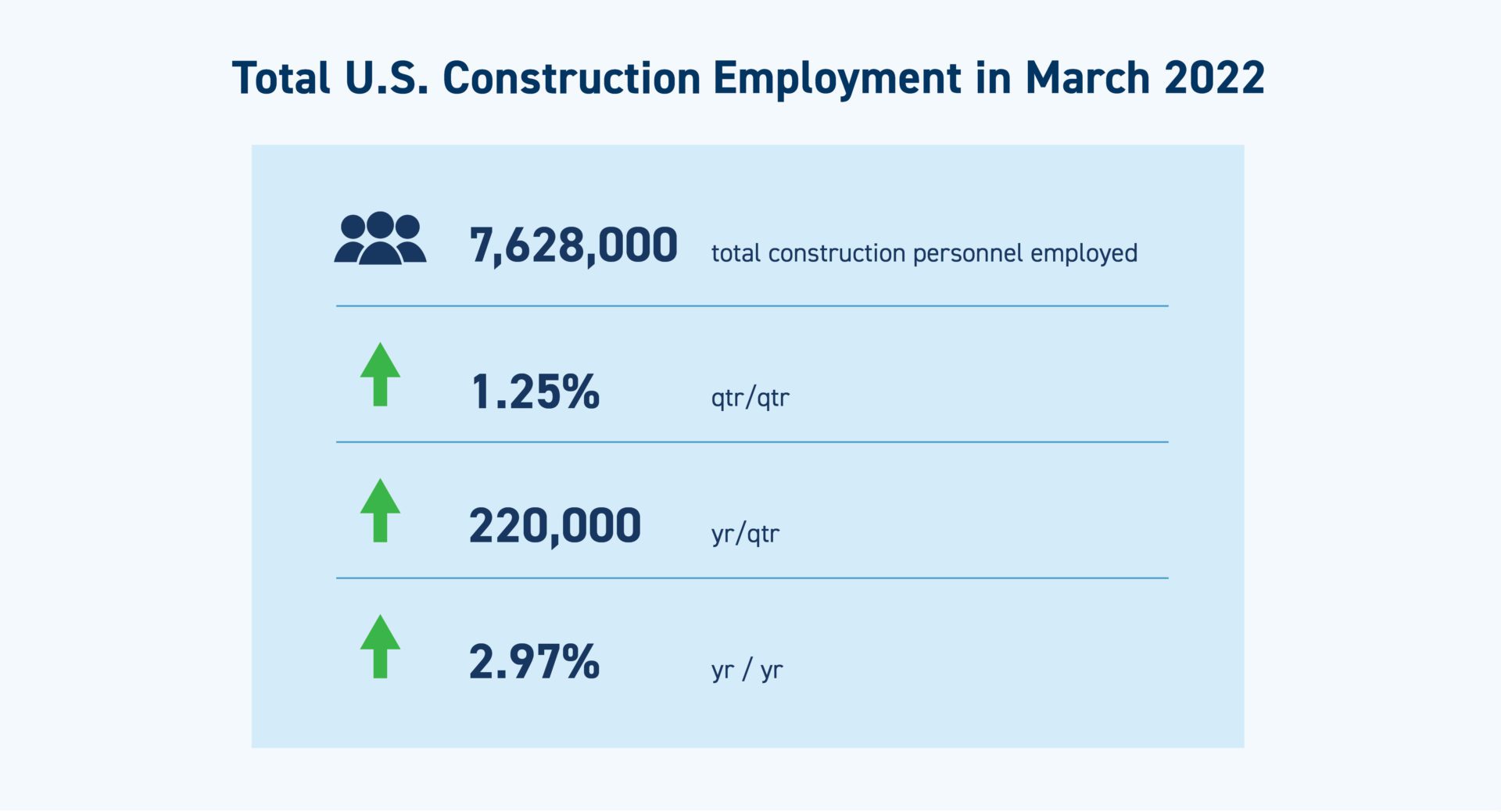

Source: U.S. Bureau of Labor Statistics

Source: ENR/ BNP Media

How ENR Builds the Index.

200 hours of common labor at the 20-city average of common labor rates, plus 25 cwt of standard structural steel shapes at the mill price range to 1996 and the fabricated 20-city price from 1996, plus 1,128 tons of portland cement at the 20-city price, plus 1,088 board ft of 2 x 4 lumber at the 20-city price.

Source: ENR

How ENR Builds the Index

68.38 hours of skilled labor at the 20-city average of bricklayers, carpenters and structural ironworkers rates, plus 25 cwt of standard structural steel shapes at the mill price prior to 1996 and the fabricated 20-city price, plus 1.128 tons of portland cement at the 20-city price, plus 1,088 board ft of 2 x 4 lumbar at the 20-city price.

Source: ENR

Sources: IHS Global Insights & ENR NOTE

Note: Escalation are annual averages.