2023 Q3 Construction Industry Economic Outlook & Trends

MARKET SHOWS POSITIVE GROWTH POTENTIAL

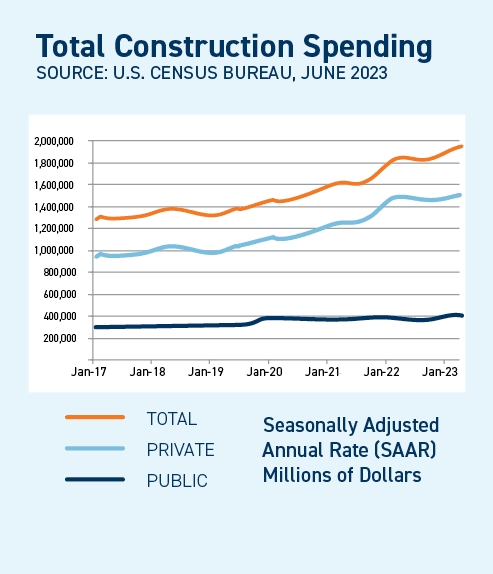

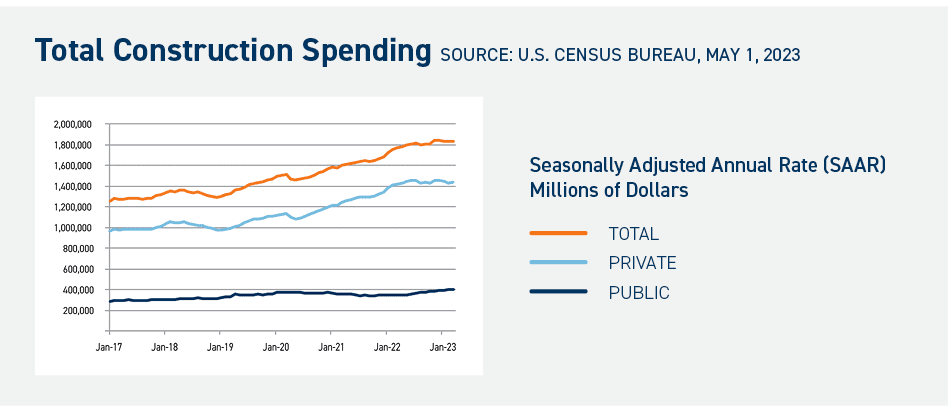

Increased public spending and shortened material lead times offer significant benefits to the construction industry, while private developers face challenging economic conditions.

The construction industry remains in flux as public sector markets benefit from increased federal spending legislation, the CHIPS Act, and the Inflation Reduction Act. However, the private developer market is struggling with lower demand, high costs, high interest rates, and tight credit rules. Despite the rise in interest rates, economic and political influences on the market suggest a solid economy. The Consumer Price Index (CPI) saw its smallest increase in over two years, at 3.2% over the past 12 months. Unemployment sits at a five-decade low, and the Federal Reserve continues to tighten its monetary policy.

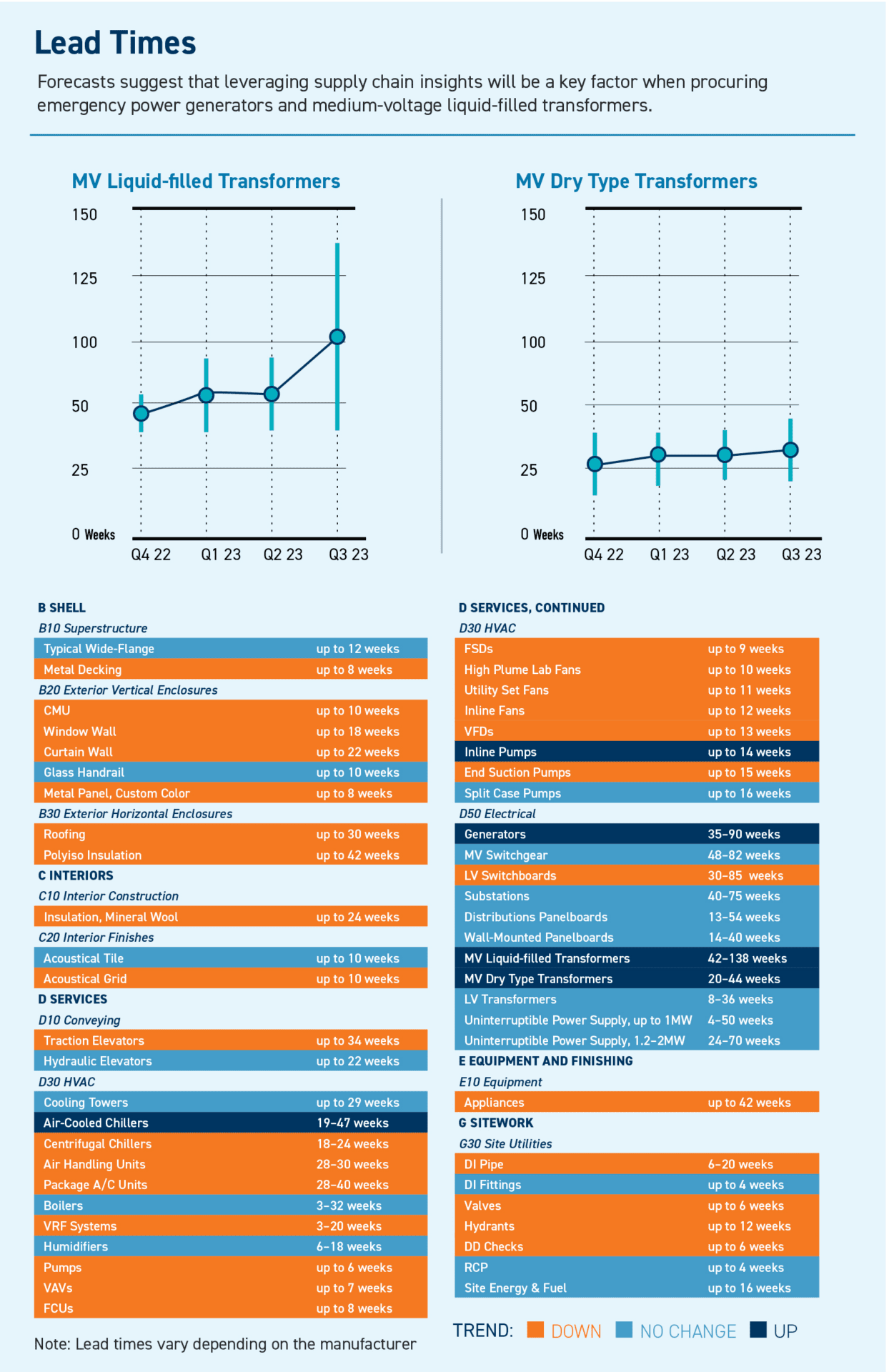

Shortened material lead times bring good news. Over 57% of tracked materials have decreased or stable lead times, with HVAC equipment showing the most significant improvements. Less than 10% of the items recorded a rise in lead times over the past quarter. The largest jumps in delivery time include large emergency power generators, rising from 70 weeks to 90 weeks, and medium voltage liquid-filled transformers, increasing from 85 weeks to 138 weeks.

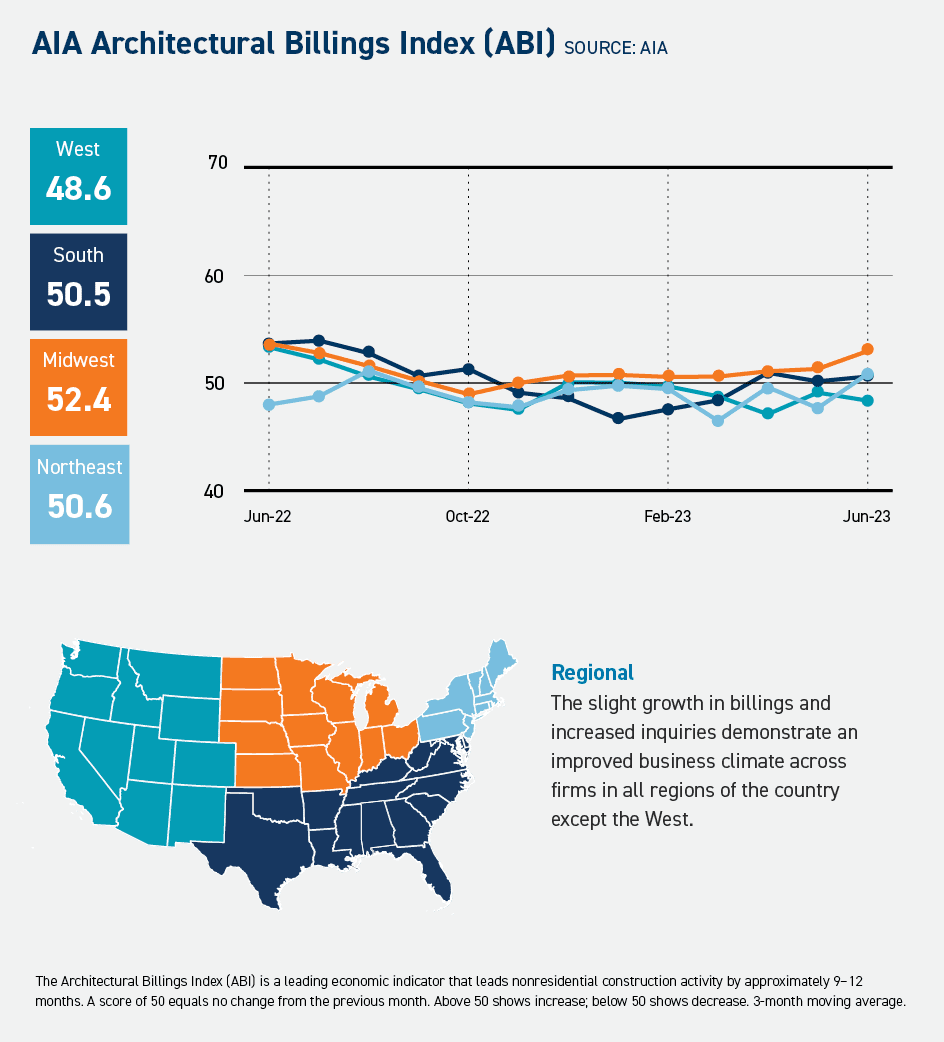

Although construction confidence remains cautious despite the positive outlook for publicly- funded and manufacturing facilities, the Architectural Billing Index (ABI) is up in all regions of the US except the West, indicating that the market appears to be moving in a positive direction. To capture that growth potential, contractors must remain proactive and efficient when bidding on projects, as competition will remain high throughout the rest of 2023 and beyond.