ENR 2024 California & Northwest Top Contractors: West Coast Builders Face Uncertainty, Shifting Priorities

Contractors are navigating mixed markets across the West Coast. Despite that, regional revenue was mostly on the rise among the firms included on the 2024 ENR California and Northwest Top Contractors lists.

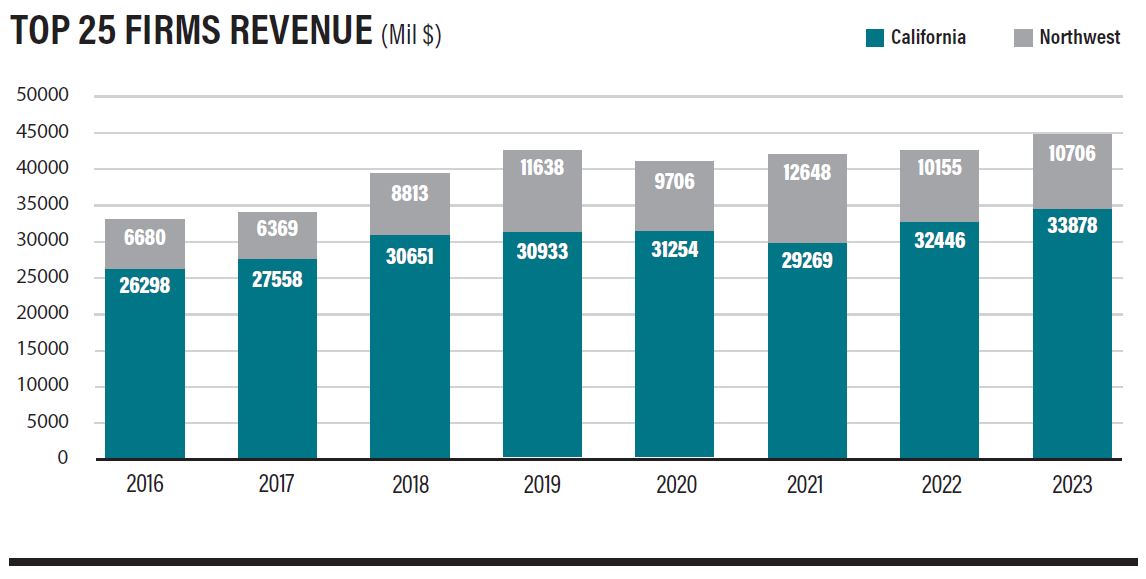

Across ENR’s 10 separate regional Top Contractors surveys, the average overall revenue increase among the top 25 firms was 7.3%. The Western regions of California, Northwest, Mountain States and Southwest collectively saw a similar increase of 7.5%. The top 25 firms in ENR Northwest and in ENR California did not meet those averages, but both continued to show growth.

The top 25 firms on ENR California’s Top Contractors list—which includes Hawaii—reported revenue of $33.9 billion for 2023, a 4.4% overall gain compared with the prior year. A year ago, that same group reported a 10.9% revenue increase, after a 6.4% decline in 2021.

The top 25 firms on ENR Northwest’s list reported $10.7 billion for 2023, a 5.4% increase over 2022. However, that increase follows a nearly 20% decline from 2021.

A Mixed Bag

The theme of 2023 was uncertainty, says Rob Westover, Bay Area co-business unit leader at DPR Construction, Redwood City, Calif. “We have great projects in our backlog, but the state of the market around speculative work has caused clients to reconsider the timing of their projects,” he says.

While that uncertainty still remains, he sees the markets becoming more focused in 2024. “The evolution of AI is driving the data center market [and] increased demand for power to fuel these projects. Securing power commitments from utility providers is a priority, and we expect that trend to continue,” he adds.

Across California, development in the commercial and life science core markets continues to be sluggish, while slowing tenant demand and elevated interest rates are affecting almost all markets, Westover says. But the advanced technology, advanced manufacturing, mission-critical and health care sectors are growing.

“The CHIPS Act funding has fueled new technical projects within the battery, semiconductor, clean energy and aerospace sectors,” Westover says. “Health care has been bolstered by new capital projects, many of which are active or in design and have start dates in 2025.”

DPR is working on two major University of California health care projects now: the four-story, 268,000-sq-ft University of California-Davis Health 48X Ambulatory Care Facility in Sacramento and the six-story, 255,000-sq-ft UC San Diego Health McGrath Outpatient Pavilion.

In 2023, the firm saw a 2% uptick in revenue across California, to $2.57 billion, as a significant number of its backlog in the advanced technology/mission critical and health care markets proceeded to construction.

Although the economy has contracted in some ways, Irvine, Calif.-based Hensel Phelps is viewing the region’s “still thriving” design and construction markets with cautious optimism, says Damian Buessing, regional vice president. “California is a resilient market where health care, life sciences, education, aviation, hospitality, power, water and other markets are still thriving,” he says.

Hensel Phelps’ revenue grew 5.8% in 2023 to $2.54 billion across California and Hawaii. One of the firm’s standout projects, done in partnership with CO Architects, is at UCI Health-Irvine, where the firms are delivering the nation’s first all-electric hospital, set for completion in fall 2025.

Meanwhile, many office markets remain depressed, particularly in Northern California, says Terry McKellips, Senior Vice President and Region Manager at Swinerton, Concord, Calif.

“Elevated interest rates have sidelined multifamily and other private construction,” he says. “Nevertheless, health care, education, aviation and affordable housing markets are strong. Despite the sluggish Bay Area rebound, Central Valley and North State revenue continues to increase as these populations continue their growth. The design-build market also remains strong.”

Swinerton posted 2023 revenue of $2.9 billion, up 4% year over year. Some of its current projects include 555 Bryant, a mixed-use apartment building in San Francisco and the historic renovation of the Hotel Del Coronado in San Diego, both set for completion in 2025.